Santander – Corporate Connect – Payment Authorisation – (Native App)

Santander – Corporate Connect – Payment Authorisation – (Native App)

Santander – Corporate Connect – Payment Authorisation – (Native App)

Santander Connect – Revolutionising Corporate Banking with Payment Authorisation📱 App (Android & iOS)

![]()

As a Senior UX/UI Designer, I led the design efforts for the Santander Connect app, a native mobile solution that streamlines payment authorisation for Santander’s Corporate & Commercial Banking clients. This project was a critical extension of the Santander Connect web-based payment authorisation system, enhancing security, accessibility, and efficiency in corporate banking transactions.

Following the successful completion of the Authorisation and Clearing Management System and Open Banking API, I was entrusted with this project to deliver a seamless, secure, and user-centric digital experience for corporate customers. The Santander Connect app allows authorised employees to approve or decline payment requests initiated through the web platform, ensuring secure and swift financial decision-making anytime, anywhere.

Complete Design Lifecycle

To create a highly effective and intuitive experience, I led the end-to-end UX/UI design process, covering:

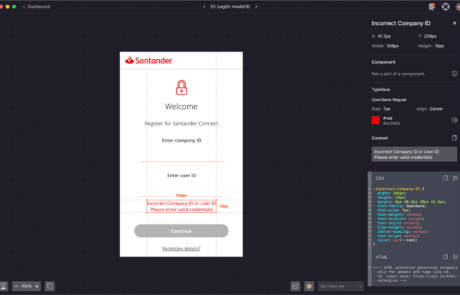

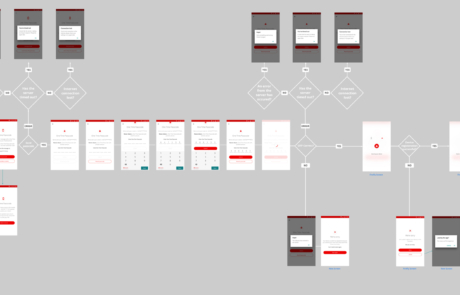

- User Research & Journey Mapping: Conducted stakeholder interviews and usability studies to understand corporate banking workflows, pain points, and security concerns. Mapped out the user journey to streamline interactions while maintaining compliance and security protocols.

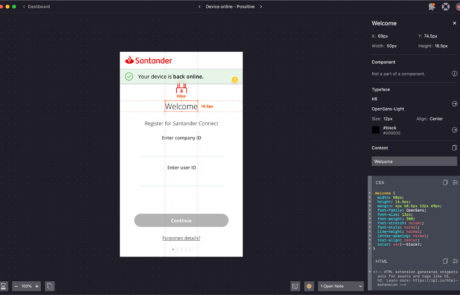

- Lo-Fidelity Wireframing & Prototyping: Created early-stage sketches and wireframes to test navigation flow and ensure an intuitive approval process.

- A/B Testing & Iterative Improvements: Conducted A/B testing on key UI elements, optimising the experience based on real user feedback, ensuring clarity, efficiency, and reduced friction in payment authorisation.

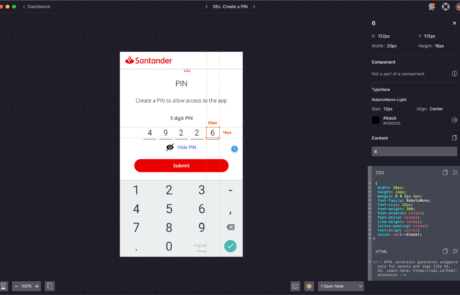

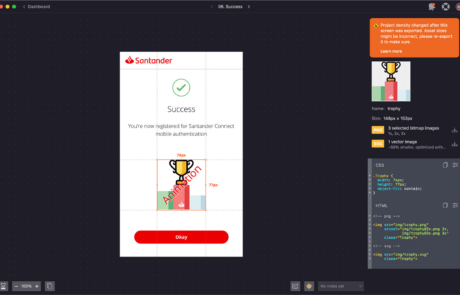

- Hi-Fidelity Design & Component Library Updates: Designed pixel-perfect hi-fidelity UI mockups, incorporating Santander’s design language and accessibility standards. Updated and expanded Santander’s design component library to introduce scalable vector animations, enhancing the app’s interactivity and engagement.

Key Features & Functionality

The Santander Connect app was built around two core functionalities:

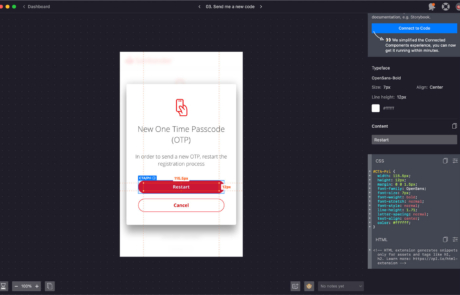

- Device Binding: Securely registering corporate users’ devices during first-time app execution via the Santander Connect portal, integrating biometric authentication for enhanced security.

- Payment Authorisation: Allowing authorised employees to view, approve, or decline payment requests, making financial transactions seamless, secure, and efficient.

The user experience covered crucial touchpoints such as account login, security & fraud checks, biometric authentication, device binding, and secure transaction processing. The app supports comprehensive corporate payment services, including single and bulk Faster Payments, Bacs, CHAPS, and International Payments, as well as features for managing standing orders and Direct Debits.

Impact & Innovation

A key milestone of this project was the introduction of JSON scalable vector animations, implemented across both the mobile and desktop platforms – a first for Santander’s fintech services. This modernised the user experience, making interactions more engaging, intuitive, and visually dynamic without compromising corporate professionalism.

By integrating modern UX principles, rigorous user testing, and Santander’s evolving design system, Santander Connect delivers a cutting-edge, secure, and user-friendly corporate banking solution that meets the demands of today’s fast-paced digital finance landscape.