Santander – Corporate Connect Payment Authorisation

Santander – Corporate Connect Payment Authorisation

Santander – Corporate Connect Payment Authorisation

This project was within Santander bank’s Corporate & Commercial Banking, with the service called Santander Connect.

About This Project

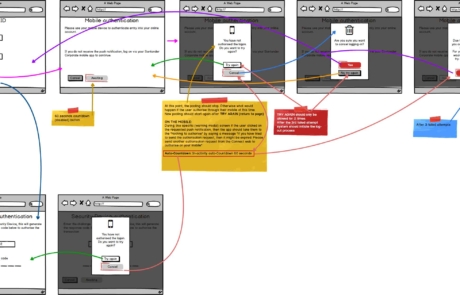

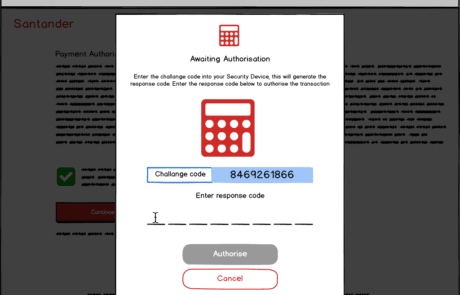

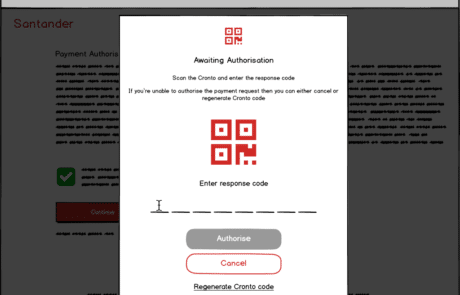

This service is to initiate a payment authorisation request and get either approval or a refusal from an authorised employee via the Santander Connect app.

After successfully delivering two of my projects within Santander (ACMS and Open Banking), I have been assigned to work in the Corporate Banking section for this project, as well as the project for the Corporate Connect native app.

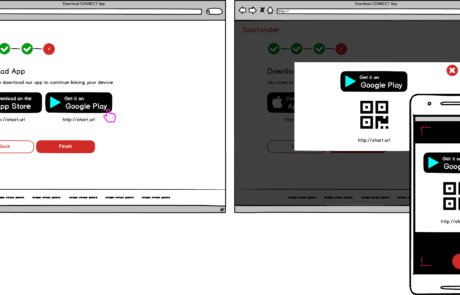

My task here was to digitally transform a legacy (the early 90s) Payment Initiation Request service to the 21st century, as well as to create and connect a greenfield native app for the Payment Authorisation.

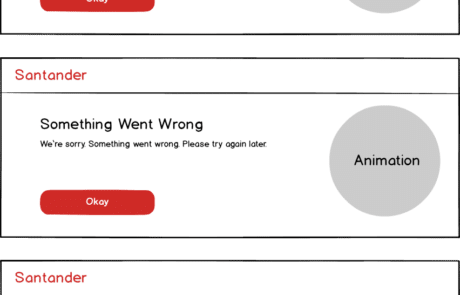

To bring the vibrancy within the fintech services, for the first time within Santander I have proudly introduced the colourful scalable vector animations within this service as well as for the Connect native app project.

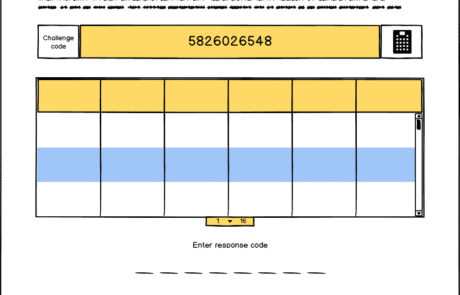

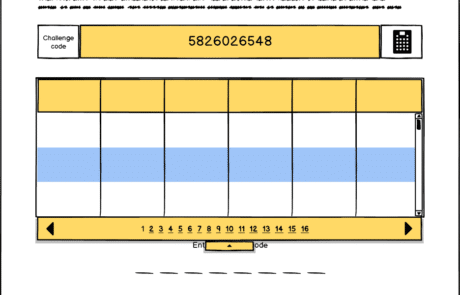

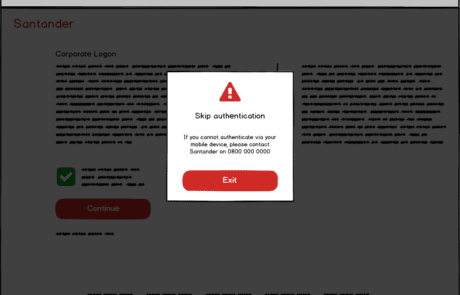

The journey involved several phases and scenarios i.e., Account login, security/fraud checks, security device etc.

This service is capable to process comprehensive payment methods to meet all payment obligations – which include single and bulk Faster Payments, Bacs, CHAPS and International payments. In addition, customers can set up and manage standing orders and view or cancel Direct Debits.