Santander – Open Banking API

Santander – Open Banking API

Santander – Open Banking API

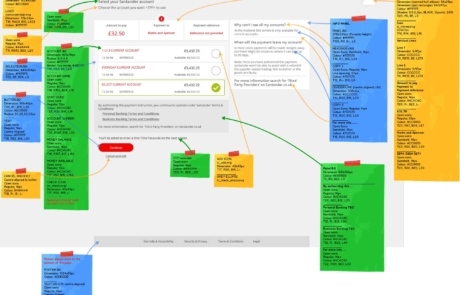

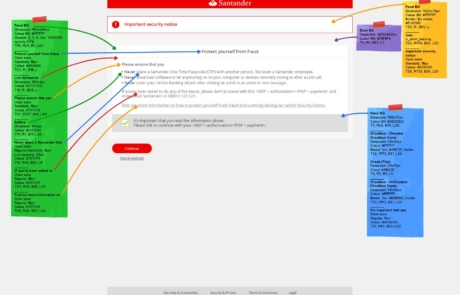

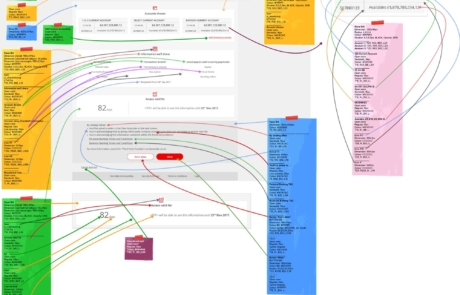

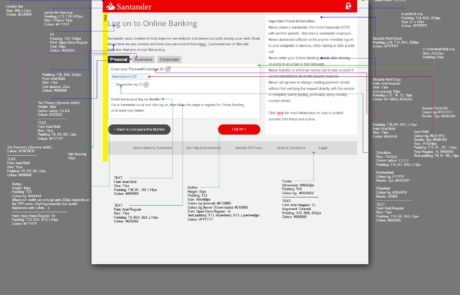

Open Banking API project within Santander bank for the Third Party Provider (TPP).

The task was to design a greenfield responsive project for the API creation for Open Banking Account Information Service Provider (AISP), and Payment Initiation Service Provider (PISP).

What is open banking?

Open banking is an opportunity for people and businesses to use their transaction data to access better financial products and services. Step into an ecosystem of apps and offerings from FinTechs and financial institutions. This service has been created to empower users, but only with their consent.

My Task

I have been assigned as the sole designer within Santander to create the entire user experience journey, as well as the user interface for the API, by keeping Santander’s brand guidelines, as well as the Financial Conduct Authority (FCA) guidance in practice.

This project consisted of two separate but linked phases of Account Information Service Provider (AISP), and Payment Initiation Service Provider (PISP).

Open Banking was a new service that no one has ever designed neither experienced before, therefore the initial user journey phase was ambiguous and unknown to everyone in the fintech industry, and to solve this issue I had to create several lo-fidelity ideology mockups to bring out the best, simple and effective solution for the overall design.