Santander – Open Banking API

Santander – Open Banking API

Santander – Open Banking API

Santander Open Banking – Enhancing Financial Connectivity via Third-Party Providers (TPPs).

Overview

Santander’s Open Banking services have been designed to empower both individuals and businesses by providing seamless access to financial data and payment services through third-party providers (TPPs). This initiative aligns with modern banking trends, offering an interconnected ecosystem of financial tools that enhance convenience and accessibility.

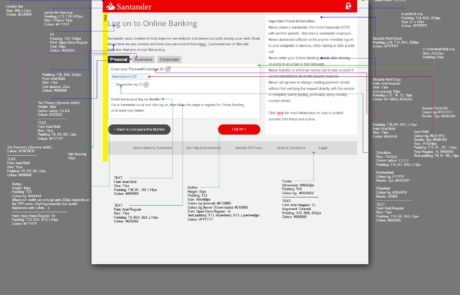

By allowing users to securely share their transaction data with authorised financial institutions and fintech applications, Santander ensures that customers can benefit from more personalised and efficient banking services across both web and mobile platforms.

Role & Responsibilities

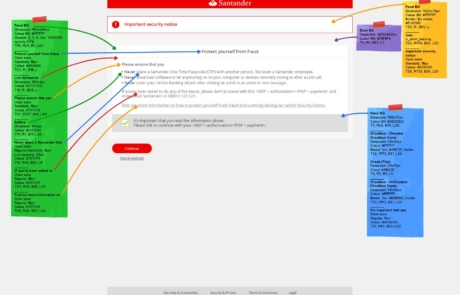

As the Sole UX/UI Designer on this initiative, I was responsible for crafting an intuitive and user-centric experience, ensuring alignment with Santander’s brand guidelines and Financial Conduct Authority (FCA) regulations. Given that Open Banking was an entirely new service within the fintech industry, the challenge lay in defining a clear and effective user journey for a system that had never been designed or implemented before.

Design Approach & Process

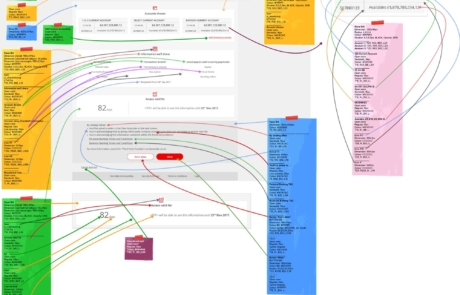

To address this challenge, I followed a comprehensive design lifecycle:

- Stakeholder Collaboration – Engaged with key stakeholders to gather insights and establish design requirements.

- User Research & Testing – Conducted in-depth research to understand customer needs and regulatory constraints.

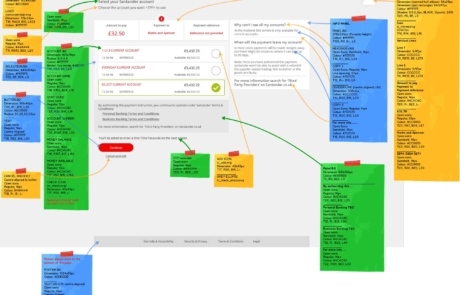

- Wireframing & Prototyping – Created multiple low-fidelity mock-ups to explore potential solutions, refining them through iterative testing.

- A/B Testing – Employed usability testing methodologies to validate design hypotheses and ensure an optimal user experience.

Design Implementation

The high-fidelity designs were meticulously crafted to align with Santander’s established component libraries, ensuring consistency and scalability across both web and mobile platforms. This involved:

- Updating design systems to accommodate Open Banking functionalities.

- Ensuring accessibility and usability across multiple devices.

- Creating an intuitive, secure, and user-friendly interface that simplifies financial data connectivity.

Outcome & Impact

By integrating Open Banking into Santander’s digital environment, customers now have greater control over their finances, with improved access to innovative financial services. Whether for personal or business banking, this initiative significantly enhances everyday banking experiences by enabling secure data sharing and seamless payment authorisations. The Open Banking system stands as a testament to how modern financial technology can drive better user experiences while maintaining the highest standards of security and compliance.